A look inside one of Connecticut’s “failing” public schools

Posted: March 27, 2013 Filed under: Education Leave a comment »

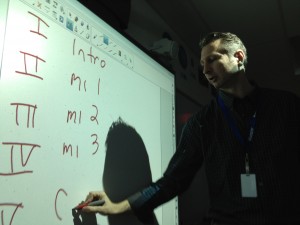

Brookside Elementary teacher Keith Morey, diagramming how to write a CMT essay for his fifth graders

Listen to Craig LeMoult’s story about the school here:

lemoult_brookside_web_130326

Brookside’s not a wealthy school. 61% of kids at the school get free or reduced price lunch based on their family incomes. About 60% of the students in the school are Hispanic, and many of their parents don’t speak English. A lot of the kids don’t have any pre-schooling before they show up for kindergarten. A recent test showed that about 38% of kids walking in the Brookside Kindergarten door didn’t have the necessary basic skills – like knowing the alphabet and recognizing shapes.

As a result of the budget crunch, the school has lost it’s full-time literacy specialist and the library is closed every other week. But Brookside Principal David Hay says it’s not an excuse.

“That’s the first thing you’ve got to accept, that you can’t say ‘because we don’t have this, we won’t be able to do something with the children,” says Hay. “You got to recognize it, it’s not going to change. Income is probably the biggest thing, because kids don’t have experiences, resources, that a lot of the wealthier kids have. So we have to try to get those for them any way we can.”

Study: disparity in college attendance & graduation

Posted: March 22, 2013 Filed under: Education Leave a comment »A report in The Atlantic this week about a study by the think tank Third Way shows the income gap in college attendance and graduation rates. The following chart shows the percentage graduating college, based on what economic quartile they’re in. And it compares the oldest Millennial generation (red line) with the youngest Baby Boomers (dotted line).

Basically, according to the study, not only are poor students far less likely to go to college, they’re far more likely to drop out, leaving them with crippling debt.

Brookings: income inequality sticking around

Posted: March 22, 2013 Filed under: General Leave a comment »A new study by the Brookings Institution says that the rise in inequality in the U.S. comes from significant changes in income over time. Co-author Bradley Heim told the Huffington Post, “it’s not that the rich will stay rich and the poor will stay poor, but that they are relatively less likely to switch positions than they were before.” HuffPo reports that according to the Economic Policy Institute, “the incomes of the top 1 percent of households spiked 241 percent between 1979 and 2007, while the incomes of the middle fifth grew just 19 percent, when adjusted for inflation.”

The Brookings study also suggests increasing federal taxes on the rich only modestly reduces inequality.

For one Conn. school, early literacy is key to closing the achievement gap

Posted: March 15, 2013 Filed under: Education Leave a comment »

Principal Pamela Baim and Vice-Principal Dena Mortensen outside a third grade classroom at F.J. Kingsbury Elementary School in Waterbury

Here’s Will Stone’s story on Kingsbury Elementary School in Waterbury:

ws_kingsbury_130227

In 2011, the difference in reading between low-income fourth graders and their wealthier peers in the state was 35 points. And that same margin exists between white students and Hispanic and African-American students. But at Kingsbury Elementary, the picture is much different.

“Right now there is very small very small gap between the Hispanic white and black population,” says Principal Pamela Baim. “If you’re looking at every child and their need, the disparity should be very small, and that’s what we’re finding here.”

The school places students in tiers according to very specific criteria, such as oral fluency, and transition students to more challenging tiers as they show improvement. Teachers also spend hours training with the school’s team of reading specialists. They rely heavily on data and diagnostic tests, using a tiered system, and addressing literacy across the curriculum. And they say it’s helping closing the gap.

From luxury to foodstamps: One story of Conn.’s economic ladder

Posted: February 13, 2013 Filed under: Employment, Income Leave a comment »Some social service workers say they’re seeing more people coming to them for help who used to be on the rich end of Connecticut’s economic spectrum. That’s the case for Ken Mathis, who used to live in a 5,500 square foot house in New Canaan when he was partner at a number of top business consulting firms and technology companies. Today, he gets by with the help of food stamps and Medicaid. Here’s his story:

lemoult_mathis_130212

Have you seen similar stories of people’s path down Connecticut’s steep economic ladder? Let us know. What does their experience say about the state’s economic disparity? Coming up soon on “State of Disparity,” we’ll share stories of people at the bottom, trying to work their way up that ladder.

Report: Conn. among worst for home ownership, credit card debt

Posted: January 30, 2013 Filed under: General, Housing Leave a comment »A new report from an economic advocacy group ranks Connecticut among the worst states for affordable home ownership and credit card debt, and it raises some interesting economic disparity issues about the state. Listen to the story here:

cel_cfed_130130

The national study from the DC-based Center for Enterprise Development found that in Connecticut, 37% of households don’t have enough money to cover basic expenses for three months if they lose their income.

“What I think is surprising is how far up the income scale liquid asset poverty reaches,” says Jennifer Brooks, director of state and local policy at CFED. She says 15% of Connecticut households that earn between $65K and $107K a year don’t have three months worth of savings.

Where Connecticut really stands out in the report is home ownership. The state ranks 42nd on the study’s measure of home affordability, which compares household income to median housing value. And the report says 41% of households in CT are paying more than a third of income for mortgage & other housing costs. And more than half of renters are using up that much of their income on housing. Brooks says there’s a huge disparity in home ownership based on income. She acknowledges it’s not surprising that high income families are more likely to own homes than low income families.

“I think that fact that Connecticut ranks 46th on this disparity measure is important, so the gap in CT is much bigger than it is in many other states,” she says.

The report shows there are also home ownership disparities based on race and family structure. It also says the average credit card debt in Connecticut is $15,000, second only to Washington DC.

CFED recommends a dozen policy recommendations in its report, including suggestions on how to reduce credit card debt and improve homeownership rates.

Nobel laureate Joseph Stiglitz: Inequality is holding back the recovery (Paul Krugman disagrees)

Posted: January 22, 2013 Filed under: Education, Employment, General, Income, Politics Leave a comment »The New York Times launched a new blog this week called The Great Divide, looking at inequality in the U.S. The blog is moderated by Joseph E. Stiglitz, a Nobel laureate in economics, a Columbia professor and a former chairman of the Council of Economic Advisers and chief economist for the World Bank. Stiglitz wrote the initial post in the blog, entitled “Inequality is holding back the recovery.”

“Politicians typically talk about rising inequality and the sluggish recovery as separate phenomena, when they are in fact intertwined,” Stiglitz writes. “Inequality stifles, restrains and holds back our growth.”

Stiglitz argues there are four major reasons inequality is squelching the recovery:

– The middle class is too weak to support the consumer spending necessary to drive growth

– The middle class is unable to invest in the future through education or starting/growing businesses

– The weak middle class holds back tax receipts needed for infrastructure, education, health, etc.

– Inequality leads to boom-and-bust cycles that make the economy more volatile and vulnerable

Stiglitz blames the economic policies of both the Obama and Bush administrations for making things worse.

“Instead of pouring money into the banks, we could have tried rebuilding the economy from the bottom up. We could have enabled homeowners who were ‘underwater’ — those who owe more money on their homes than the homes are worth — to get a fresh start, by writing down principal, in exchange for giving banks a share of the gains if and when home prices recovered. We could have recognized that when young people are jobless, their skills atrophy. We could have made sure that every young person was either in school, in a training program or on a job. Instead, we let youth unemployment rise to twice the national average. The children of the rich can stay in college or attend graduate school, without accumulating enormous debt, or take unpaid internships to beef up their résumés. Not so for those in the middle and bottom. We are sowing the seeds of ever more inequality in the coming years.”

He offers suggestions for President Obama’s second term.

“What’s needed is a comprehensive response that should include, at least, significant investments in education, a more progressive tax system and a tax on financial speculation.”

A lot to talk about here. Do you agree with Stiglitz’s arguments? Do you think inequality is holding us back from an economic recovery? What about his prescription for fixing it? Would education investment or a more progressive tax system make a difference?

Economist and New York Times columnist Paul Krugman (also a Nobel laureate) disagrees with him. In two responses to Stiglitz (Jan. 20 & Jan. 21), he says he’d love to blame slow growth on inequality. “But I couldn’t and can’t convince myself that the theory and evidence really support that view,” he writes in the second piece. “Inequality is a huge problem – but not for employment growth in 2013 or 2014.”

President Obama’s inaugural speech: “Our country cannot succeed” without addressing economic disparity

Posted: January 21, 2013 Filed under: Education Leave a comment »

In his second inaugural address, President Obama directly commented on the issue of economic disparity in the U.S. Hear his comments here:

obama_disparity_web_130121

Here’s the transcript of his remarks:

“For we, the people, understand that our country cannot succeed when a shrinking few do very well and a growing many barely make it. We believe that America’s prosperity must rest upon the broad shoulders of a rising middle class. We know that America thrives when every person can find independence and pride in their work; when the wages of honest labor liberate families from the brink of hardship. We are true to our creed when a little girl born into the bleakest poverty knows that she has the same chance to succeed as anybody else, because she is an American, she is free, and she is equal, not just in the eyes of God but also in our own.”

Within the President’s comments is the suggestion that we are NOT being “true to our creed,” since that little girl doesn’t have the same chance to succeed. What, if anything, can or should be done to meet the President’s goal? Please share your thoughts and suggestions.

Conn. inequality compared to Bangkok in “The Great Divide” series

Posted: January 17, 2013 Filed under: General Leave a comment »International media outlet and NPR partner GlobalPost is doing a series on income inequality around the world called “The Great Divide”, and they’ve just released a print story and video comparing inequality in Connecticut and in Bangkok. Both areas have similar GINI index scores. (Here’s a Conn. State Data Center map of GINI scores across the country and comparing them internationally, and here’s one looking at the scores withing Conn. cities and towns). Check out this GlobalPost video about Connectictut and Bangkok:

The GlobalPost print story describes the impact that the ending of county governments had on increasing economic disparity. The reporters spoke with Bridgeport resident (and sometime mayoral candidate) Jeff Kohut:

“In Connecticut, this process was supercharged when, in 1960, the suburban interests succeeded in changing the state constitution to abolish Connecticut’s eight county governments, eliminating any hope that the affluence surrounding Bridgeport or other struggling cities could be harnessed for redevelopment. Bridgeport natives like Kohut view this as a betrayal. The migration of more prosperous residents that fed the growth of neighboring towns like Stratford, Trumbull and Fairfield — ‘colonies of Bridgeport, if you will,’ says Kohut — encouraged a selfishness that exacerbated his hometown’s decline.”

The companion print story about Bangkok is online here.

Report says Conn. poor taxed more than rich

Posted: January 17, 2013 Filed under: Uncategorized Leave a comment »A new report by the advocacy group Connecticut Voices for Children says 180,000 households benefited from Connecticut’s Earned Income Tax Credit last year. And the report’s authors say the state taxes poor people at a higher percentage than the rich.

You can hear Will Stone’s story on the EITC report here:

ws_taxcredit_130110

Governor Dannel Malloy launched the EITC in 2011 as a supplement to the federal tax credit. It’s designed to help working families, especially those with children. On average, households that filed for the credit were making $18,000 a year and received a credit of $600. The credit depends on income and number of children, though, which means a family with two children, could receive a maximum credit of about $1,500.

Wade Gibson of Connecticut Voices for Children is one of the authors of the report. He says these families are already shouldering a heavy tax burden.

“These folks are the highest taxed people in Connecticut in terms of state and local taxes because in Connecticut we actually tax poor people more as a proportion of their income than we tax rich people. About twice as much actually”

Gibson says this discrepancy results from the way property and sales taxes affect different communities. For example, he says a family making 18,000 dollars a year will spend more of its money on goods. And as a result about 5% of their income will be spent on sales taxes alone. The state credit is currently 30% of the federal income tax credit. He says the two credits will continue to be crucial in keeping Connecticut families out of poverty.

Recent Comments